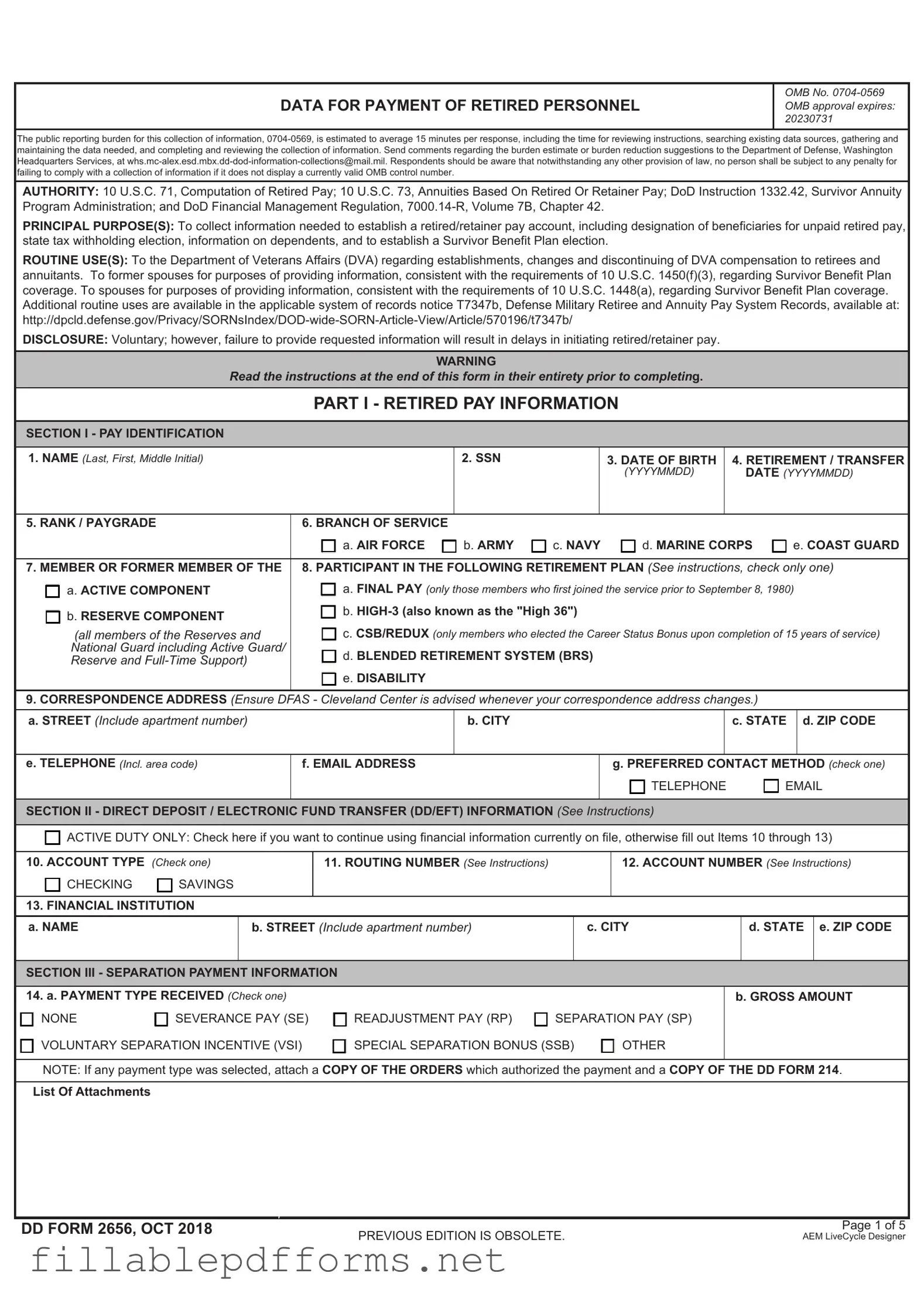

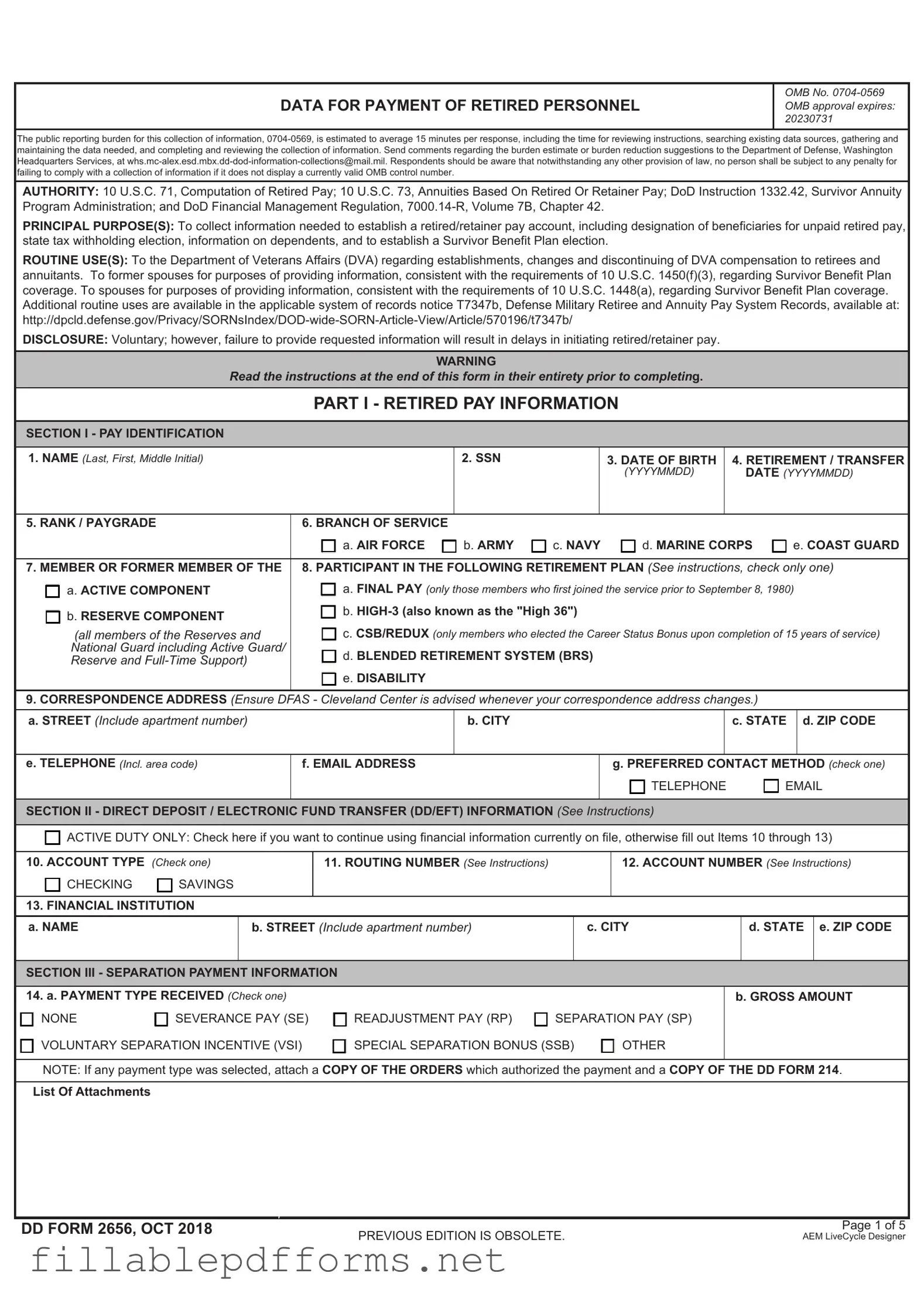

The DD 2656 form, also known as the "Data for Payment of Retired Personnel," is an important document for military retirees. However, several misconceptions exist about its purpose and use. Below is a list of ten common misconceptions, along with clarifications to help you better understand this essential form.

- Misconception 1: The DD 2656 form is only for retired military personnel.

This form is not limited to just retirees. It can also be used by those who are about to retire and need to provide necessary information for their retirement benefits.

- Misconception 2: Filling out the DD 2656 is optional.

In fact, completing this form is mandatory for processing retirement benefits. Without it, there may be delays or issues with receiving payments.

- Misconception 3: The DD 2656 form only collects basic personal information.

While it does ask for personal details, it also requires information about beneficiaries, payment options, and tax withholding preferences.

- Misconception 4: You can submit the DD 2656 form at any time after retirement.

There is a specific time frame for submitting this form. It should be completed and submitted as part of the retirement process to ensure timely benefits.

- Misconception 5: Once the DD 2656 is submitted, you cannot make changes.

Changes can be made if necessary, but it is advisable to do so promptly. Contacting the appropriate military finance office will help facilitate any updates.

- Misconception 6: The DD 2656 form is the same for all branches of the military.

While the form serves a similar purpose across branches, there may be slight variations or additional requirements depending on the specific military branch.

- Misconception 7: You can complete the DD 2656 form without assistance.

Many retirees find it beneficial to seek assistance from a knowledgeable source, such as a legal document preparer or a military benefits advisor, to ensure accuracy.

- Misconception 8: The DD 2656 form is only relevant for those who served a full career.

Even those who served a shorter term may need to complete the form to access certain benefits, depending on their service and circumstances.

- Misconception 9: You can ignore tax withholding preferences on the DD 2656.

Choosing tax withholding options is crucial. Failing to do so can lead to unexpected tax liabilities when benefits begin to be paid out.

- Misconception 10: The DD 2656 form is a one-time requirement.

This form may need to be updated or resubmitted if there are changes in your personal situation, such as marriage, divorce, or the birth of a child.

Understanding these misconceptions can aid in navigating the retirement process more effectively. Accurate completion of the DD 2656 form is vital for ensuring that retirement benefits are received without unnecessary complications.