Citibank Direct Deposit PDF Template

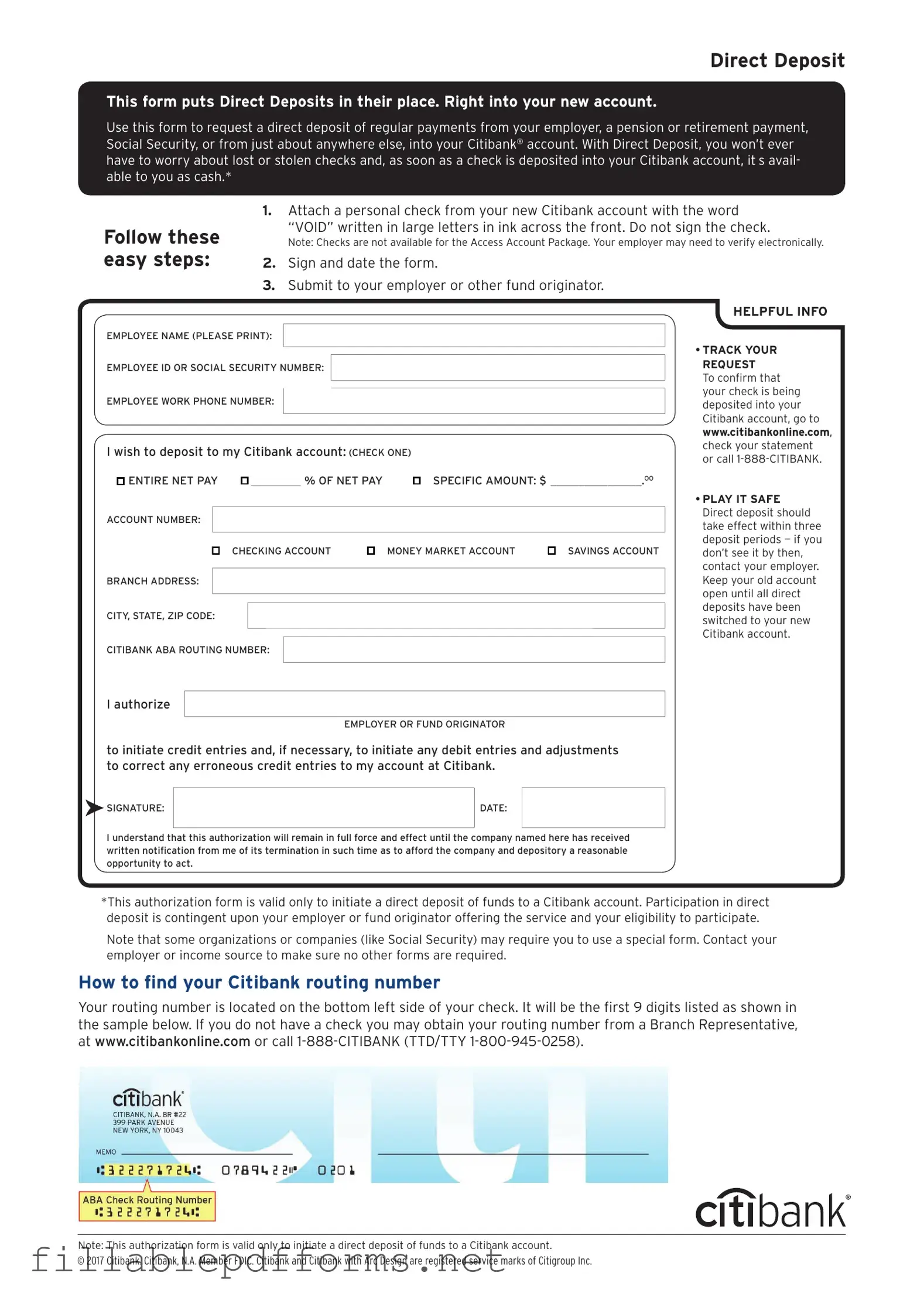

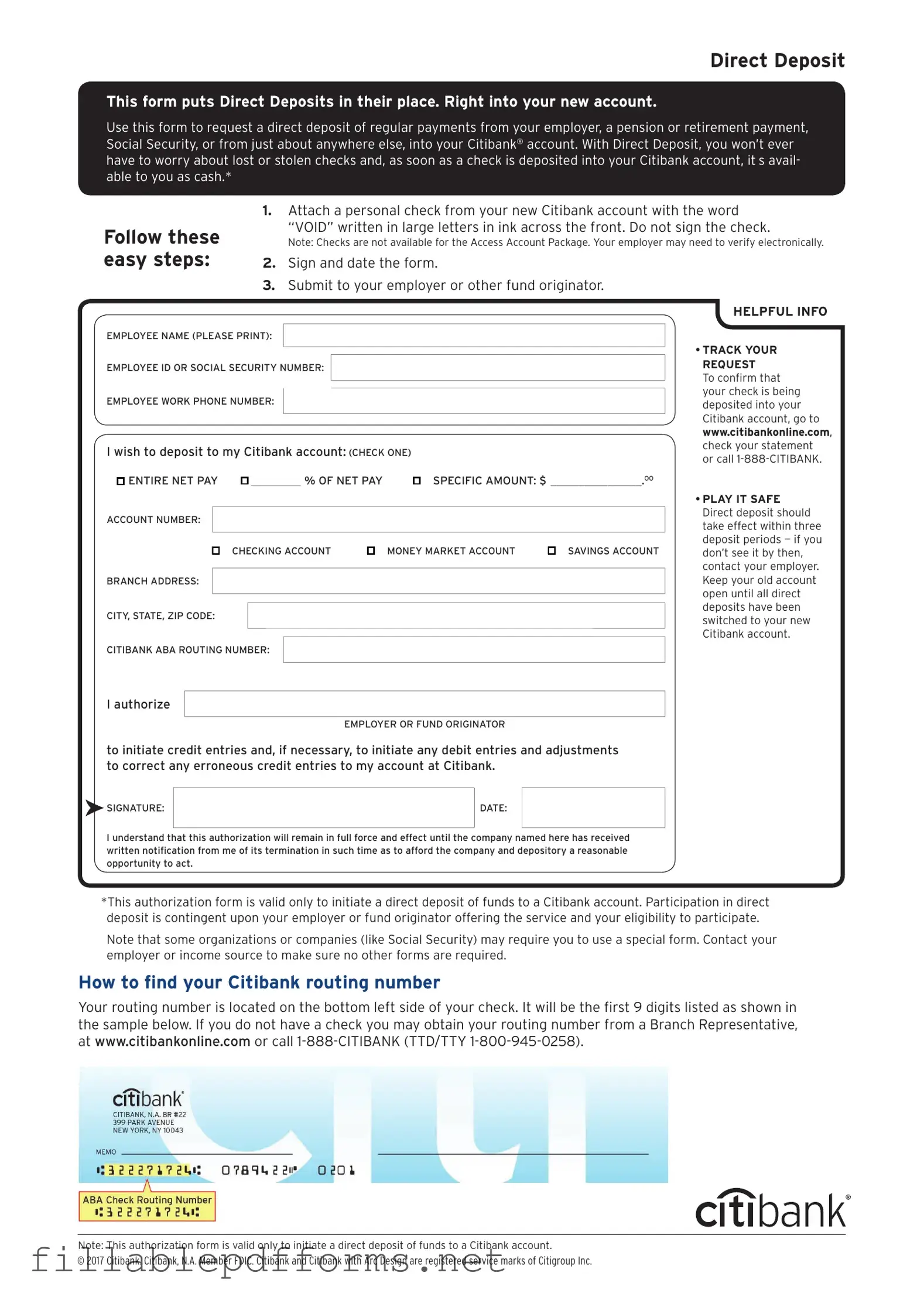

The Citibank Direct Deposit form is a document that allows individuals to authorize their employer or other payers to deposit funds directly into their Citibank account. This process simplifies receiving payments, ensuring timely access to funds without the need for physical checks. Completing this form is a straightforward way to manage finances efficiently.

Launch Editor Here

Citibank Direct Deposit PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Citibank Direct Deposit PDF

Almost there — finish the form

Complete Citibank Direct Deposit online fast — no printing, no scanning.