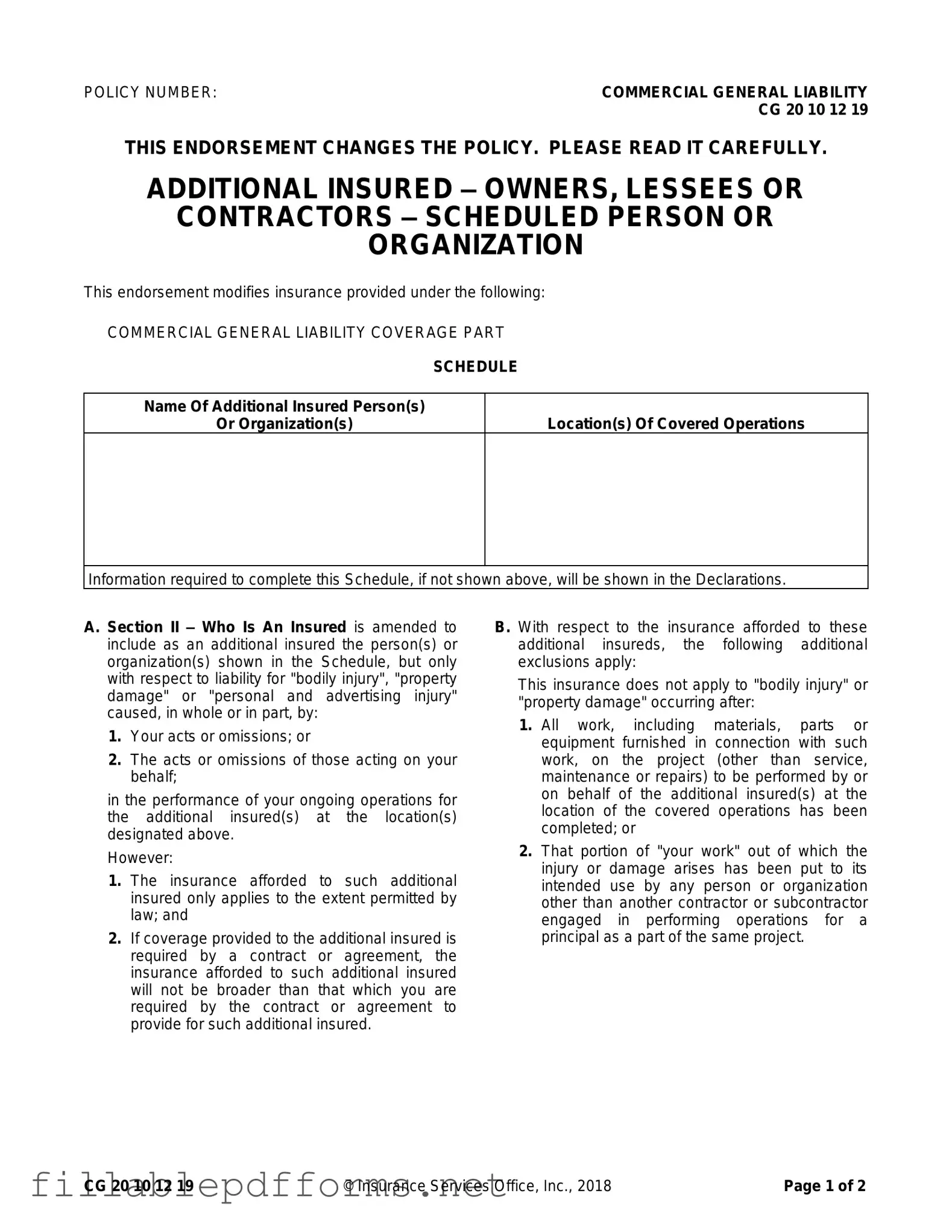

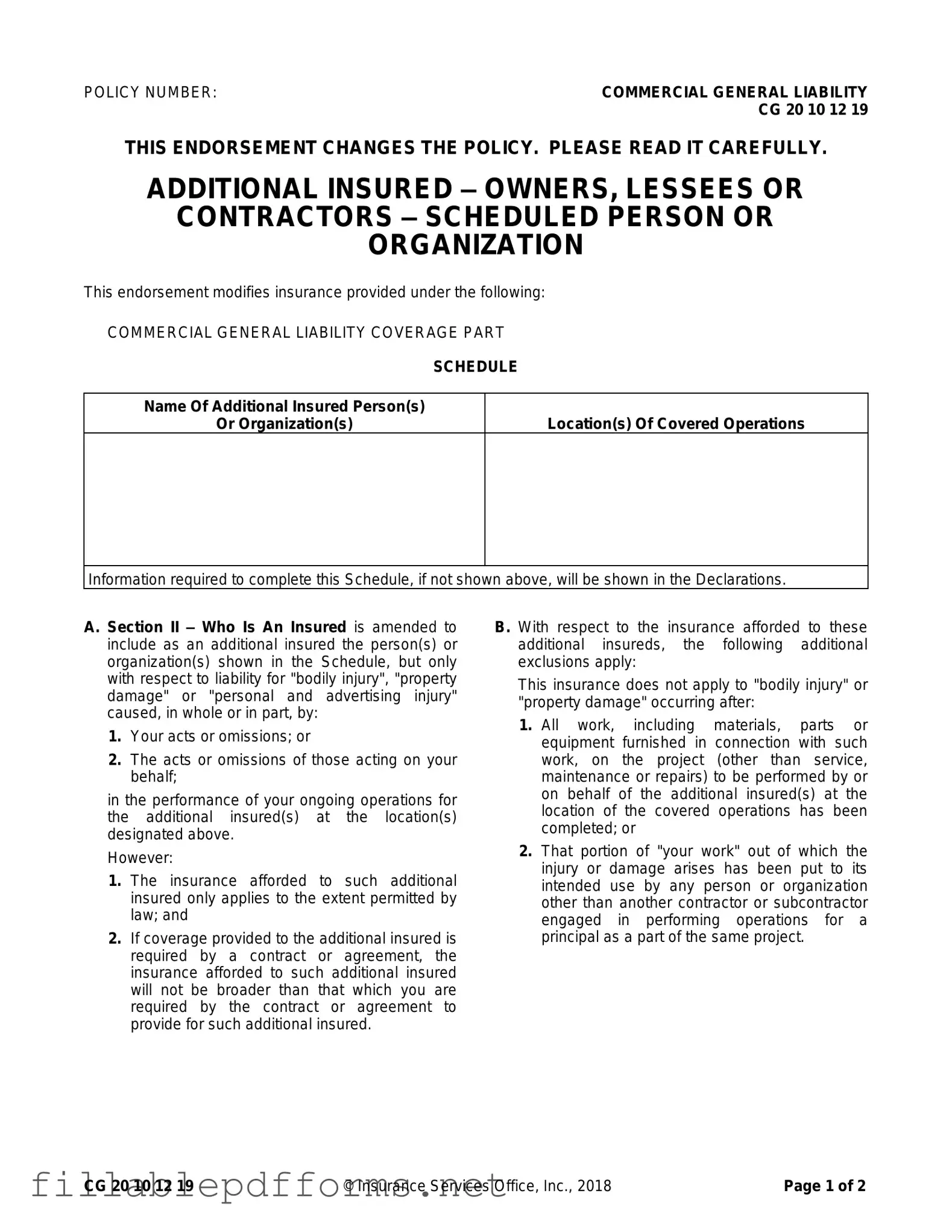

Cg 20 10 07 04 Liability Endorsement PDF Template

The CG 20 10 07 04 Liability Endorsement is a crucial document that modifies a Commercial General Liability policy, specifically designed to extend coverage to additional insured parties. This endorsement ensures that owners, lessees, or contractors named in the policy are protected against certain liabilities arising from the insured's operations. Understanding the specifics of this endorsement can significantly impact risk management and liability exposure for businesses.

Launch Editor Here

Cg 20 10 07 04 Liability Endorsement PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Cg 20 10 07 04 Liability Endorsement PDF

Almost there — finish the form

Complete Cg 20 10 07 04 Liability Endorsement online fast — no printing, no scanning.