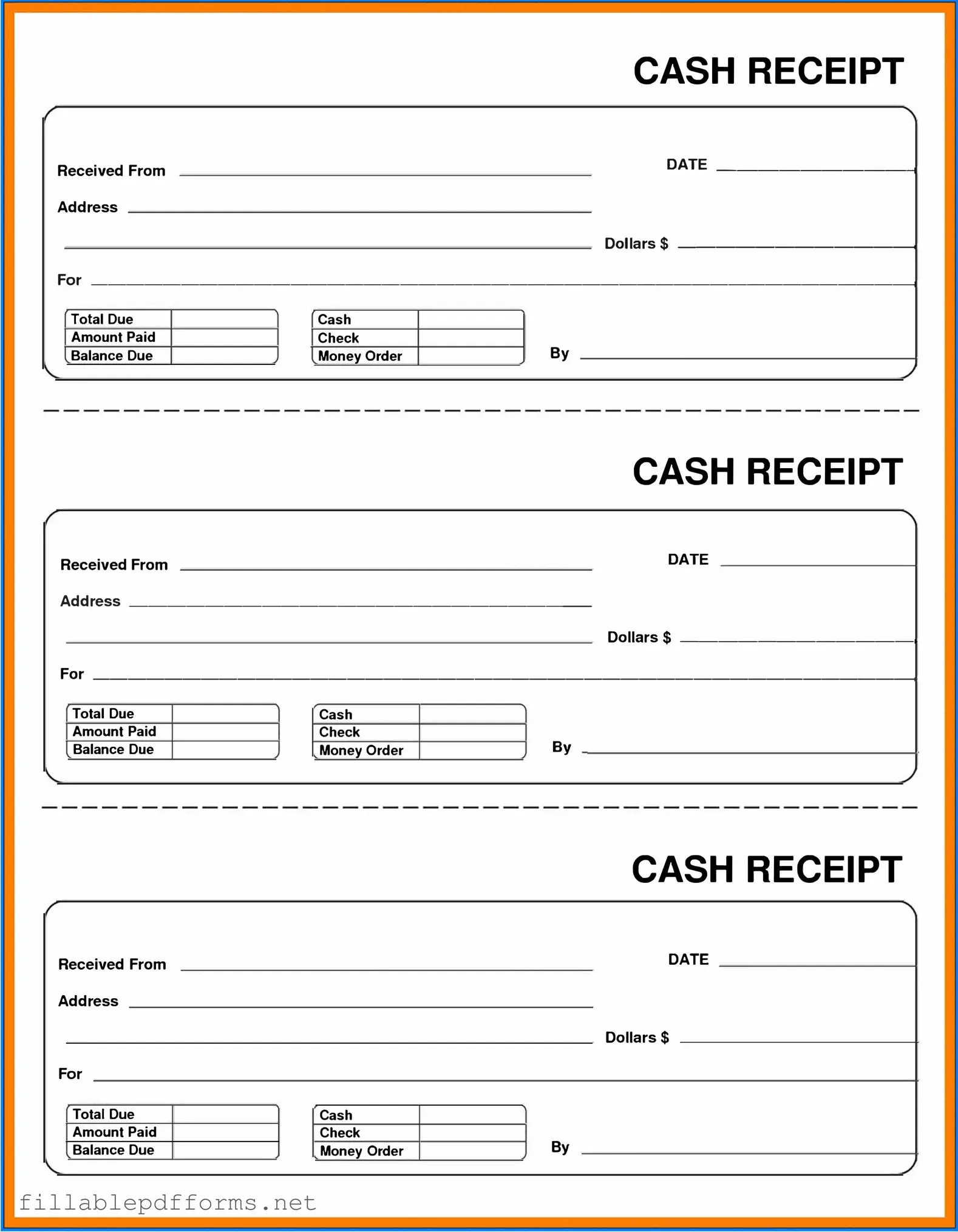

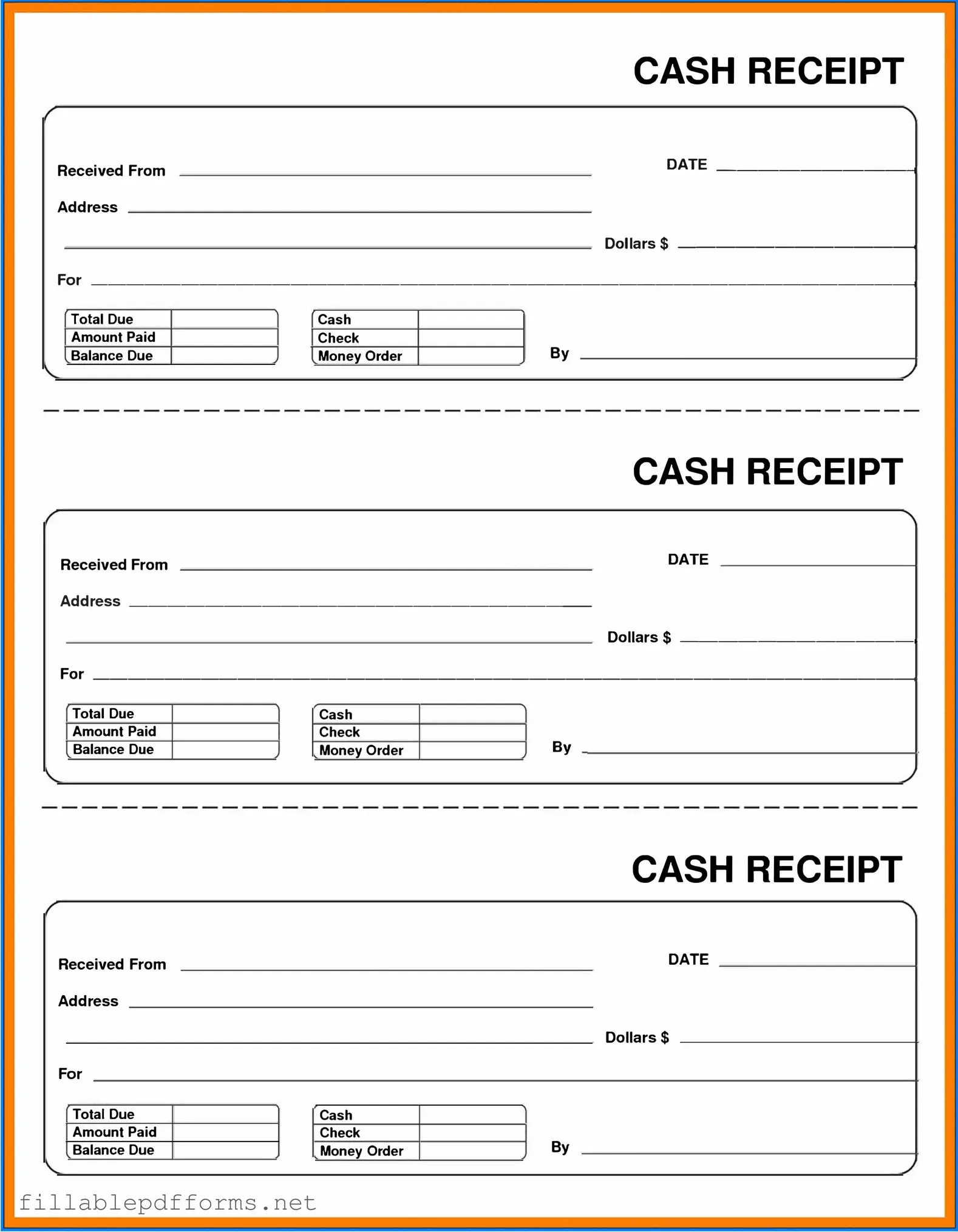

Cash Receipt PDF Template

A Cash Receipt form is a document used to record the receipt of cash payments. This form serves as proof of transaction for both the payer and the recipient. It helps maintain accurate financial records and ensures transparency in cash handling.

Launch Editor Here

Cash Receipt PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Cash Receipt PDF

Almost there — finish the form

Complete Cash Receipt online fast — no printing, no scanning.