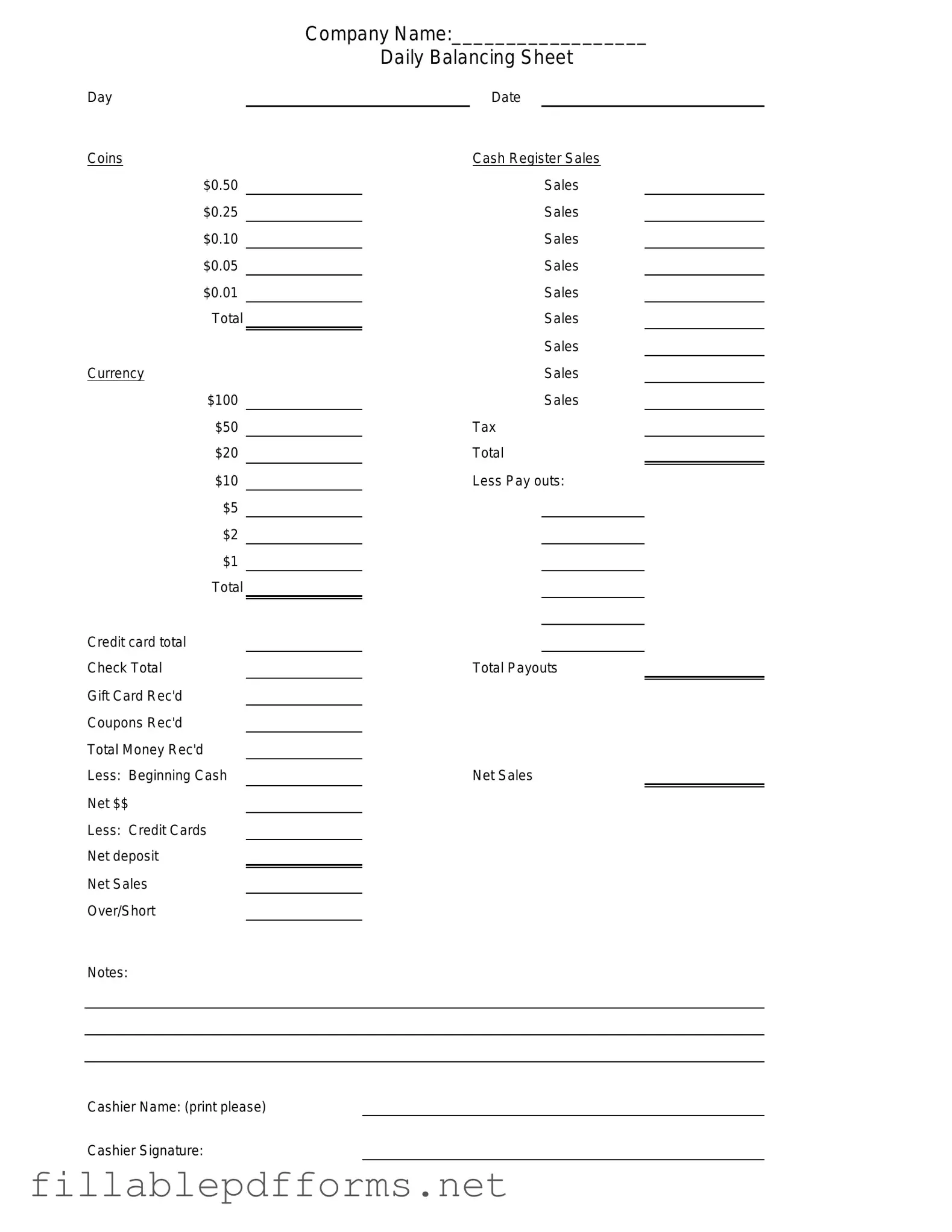

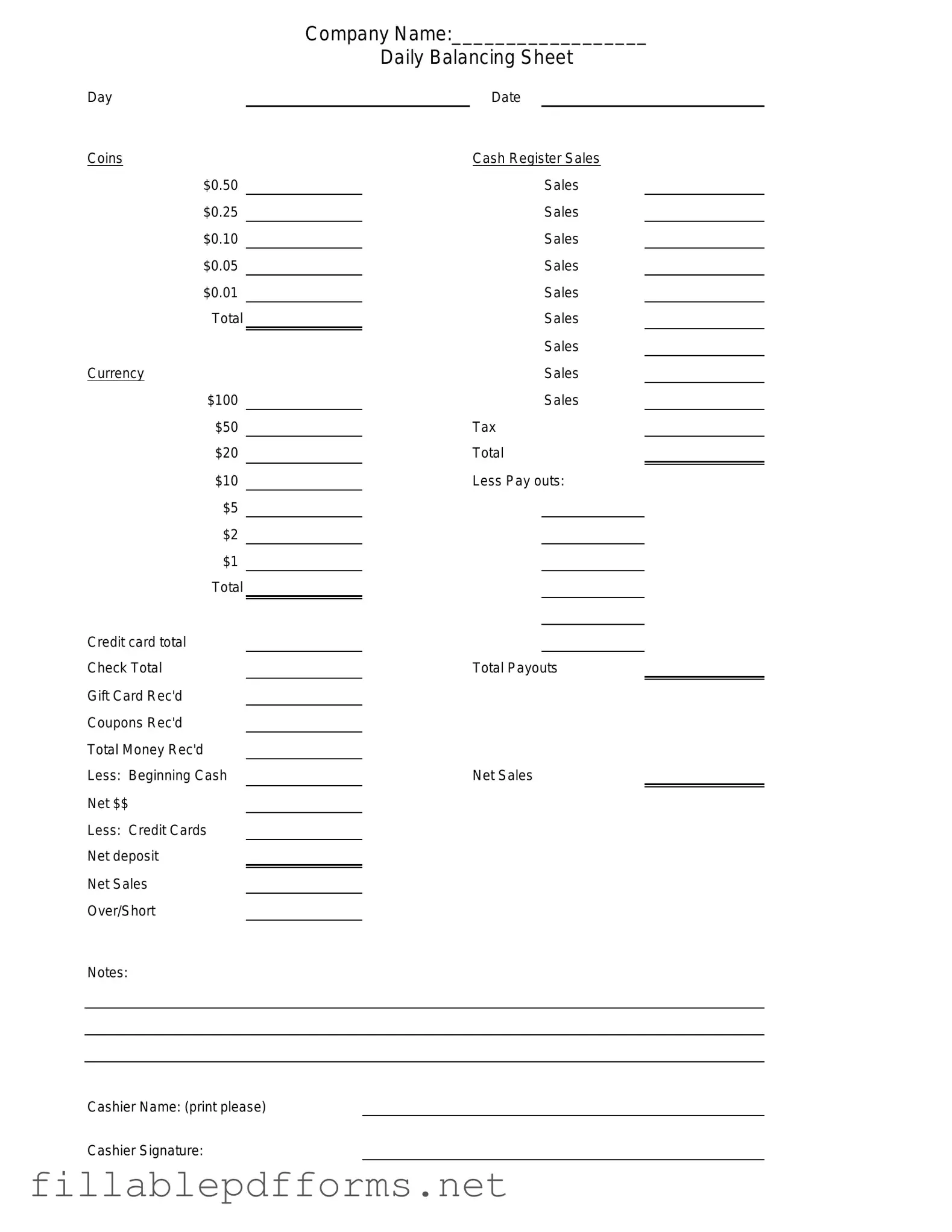

Cash Drawer Count Sheet PDF Template

The Cash Drawer Count Sheet is a document used by businesses to record the cash amount present in a cash drawer at the end of a shift or business day. This form helps ensure accurate financial reporting and assists in identifying discrepancies. By maintaining a detailed record, businesses can enhance accountability and streamline cash management processes.

Launch Editor Here

Cash Drawer Count Sheet PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Cash Drawer Count Sheet PDF

Almost there — finish the form

Complete Cash Drawer Count Sheet online fast — no printing, no scanning.