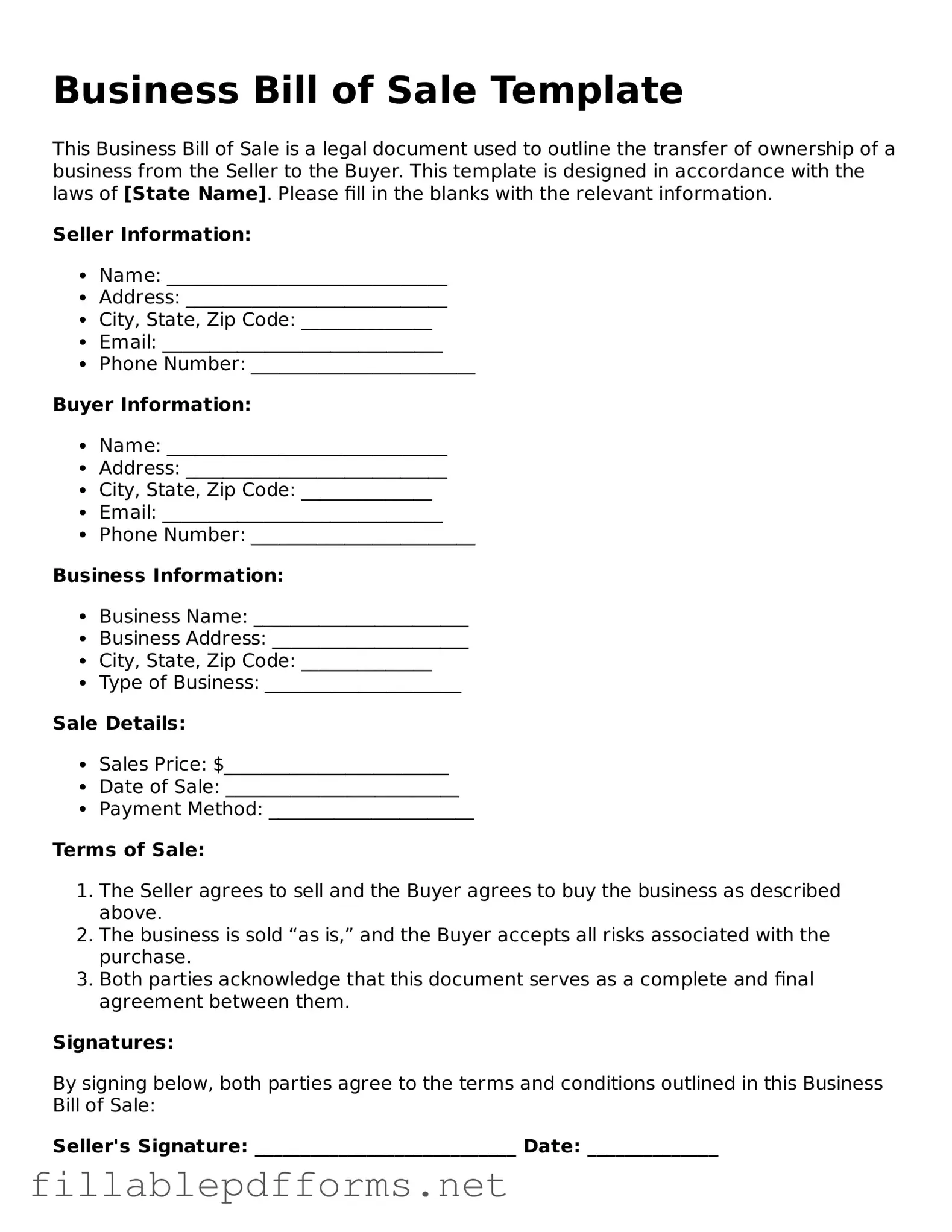

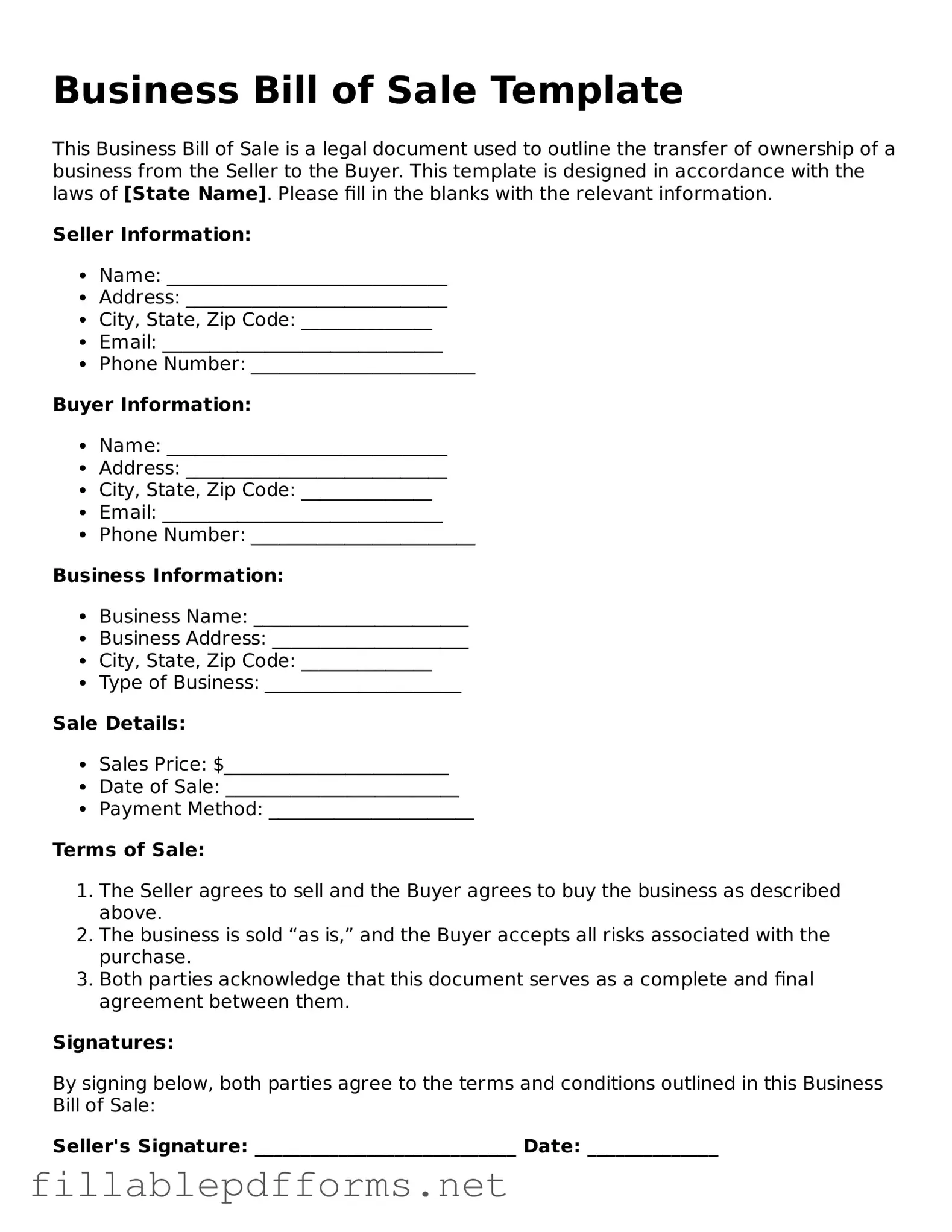

Blank Business Bill of Sale Template

A Business Bill of Sale is a legal document used to transfer ownership of a business or its assets from one party to another. This form outlines the details of the transaction, including the items being sold and the terms of the sale. It serves as proof of the transfer and protects both the buyer and the seller in the process.

Launch Editor Here

Blank Business Bill of Sale Template

Launch Editor Here

Launch Editor Here

or

▼ Business Bill of Sale PDF

Almost there — finish the form

Complete Business Bill of Sale online fast — no printing, no scanning.