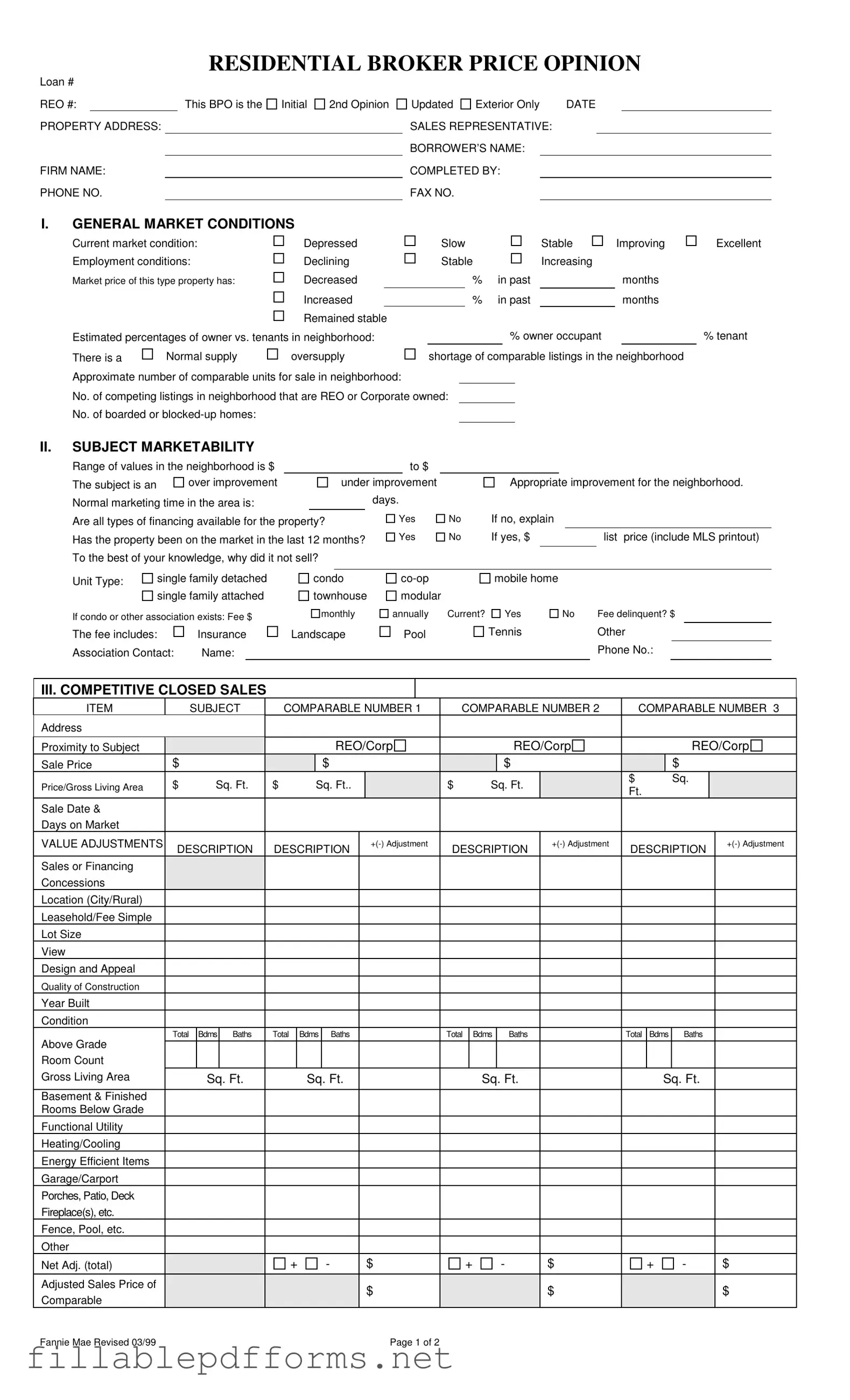

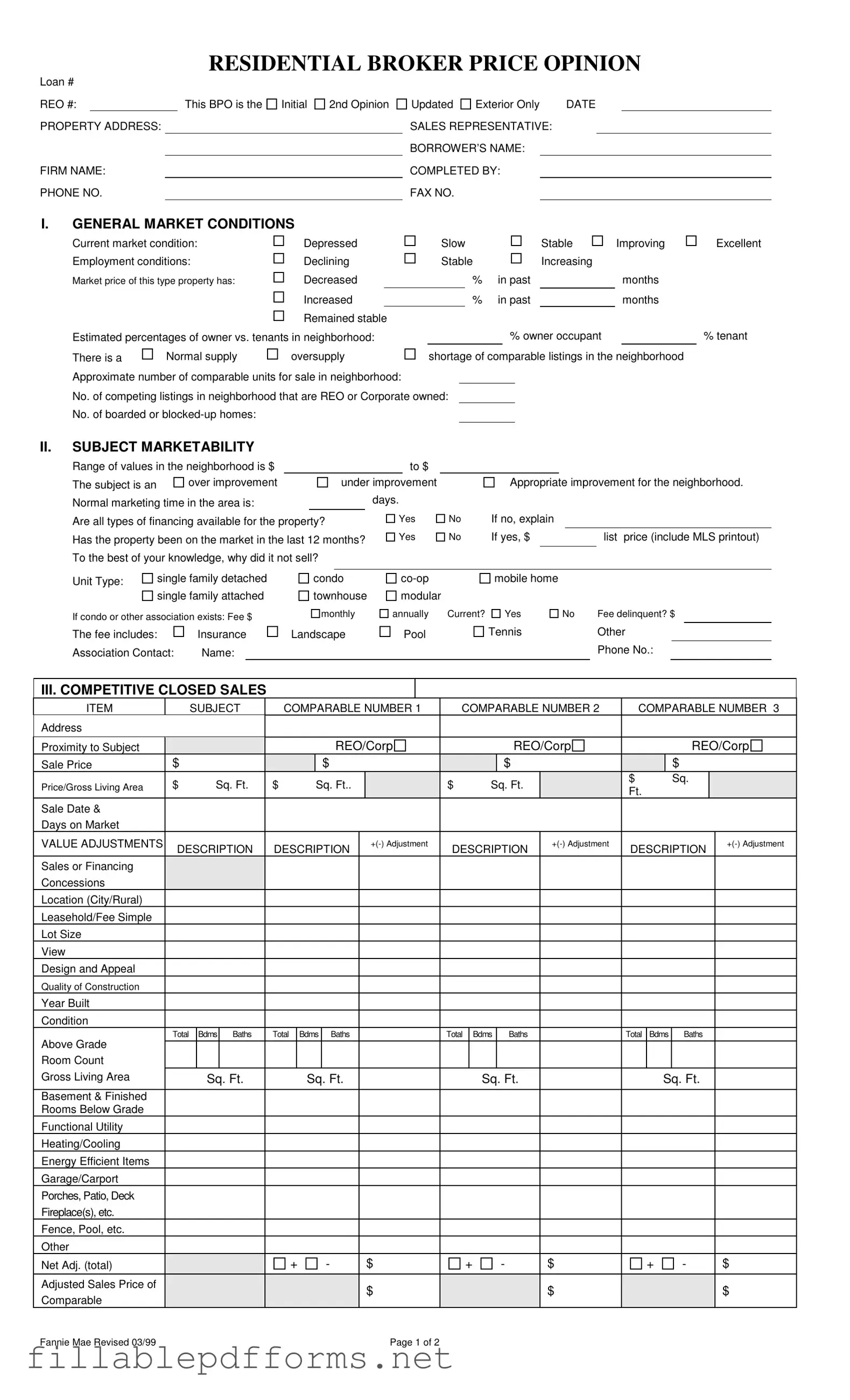

Broker Price Opinion PDF Template

The Broker Price Opinion (BPO) form is a tool used by real estate professionals to assess the value of a property. It provides a detailed analysis of the market conditions, comparable sales, and the subject property's characteristics. This form is often utilized by lenders and investors to make informed decisions regarding property transactions.

Launch Editor Here

Broker Price Opinion PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Broker Price Opinion PDF

Almost there — finish the form

Complete Broker Price Opinion online fast — no printing, no scanning.