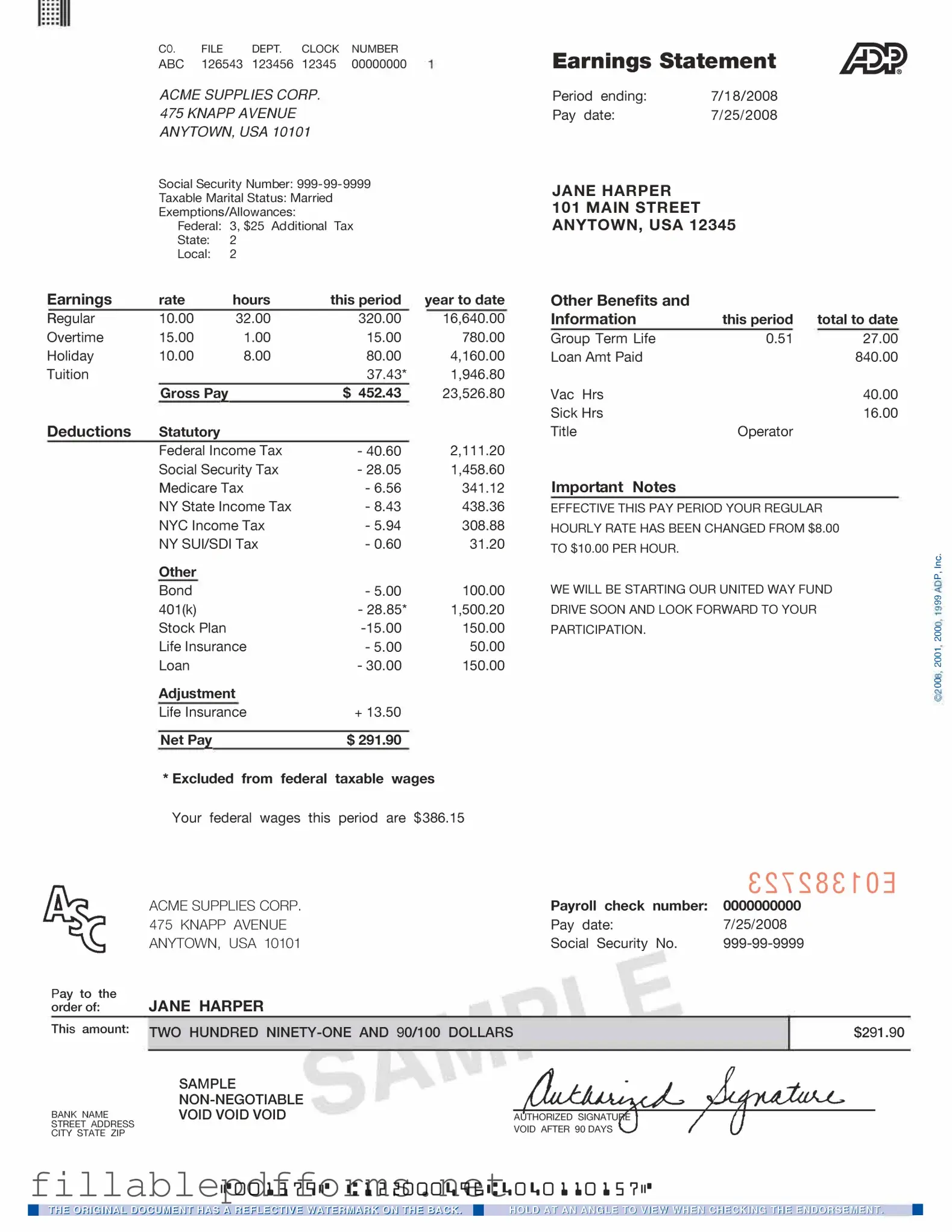

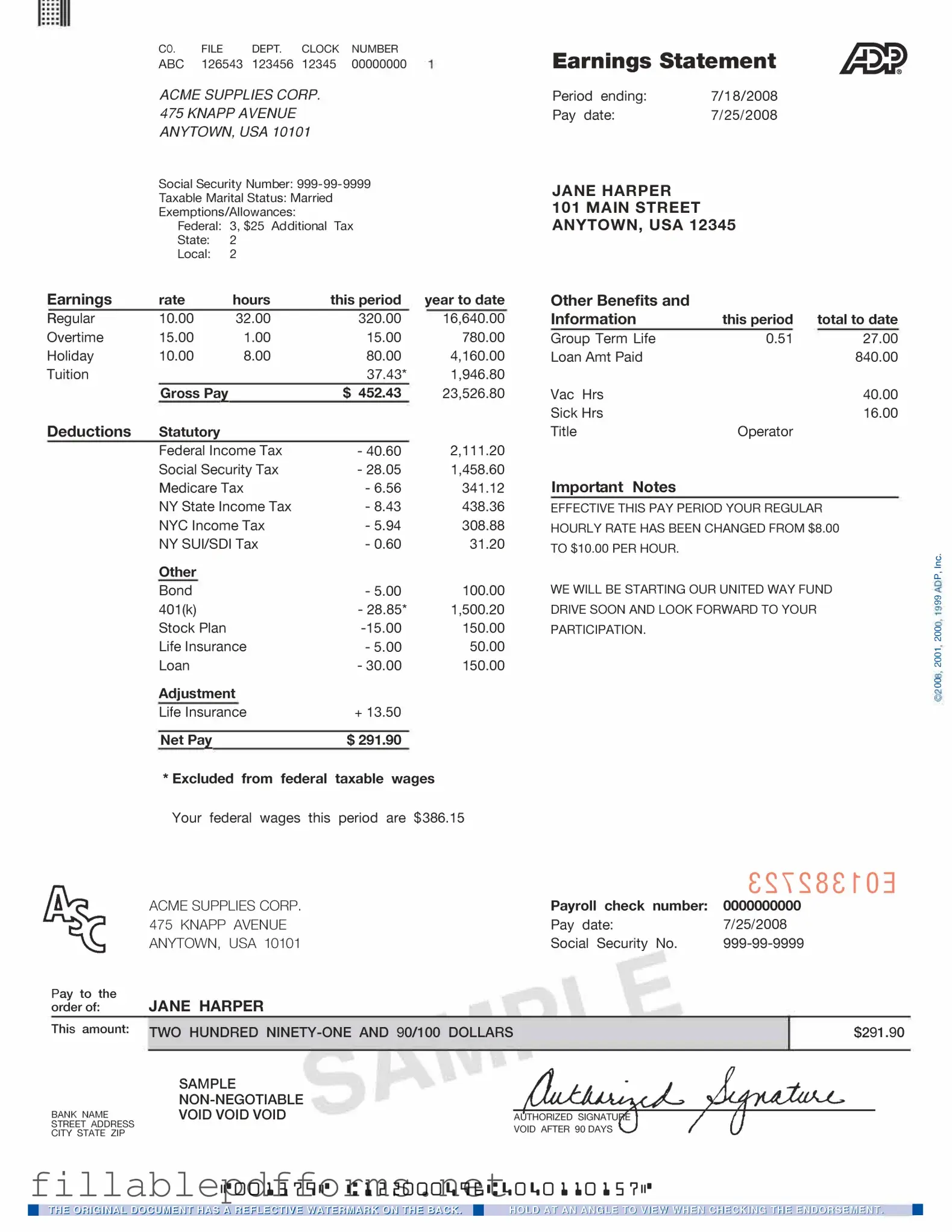

Adp Pay Stub PDF Template

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. This form serves as an essential tool for understanding compensation and ensuring accurate financial records. By reviewing the pay stub, employees can track their income and confirm that all deductions are correctly applied.

Launch Editor Here

Adp Pay Stub PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Adp Pay Stub PDF

Almost there — finish the form

Complete Adp Pay Stub online fast — no printing, no scanning.