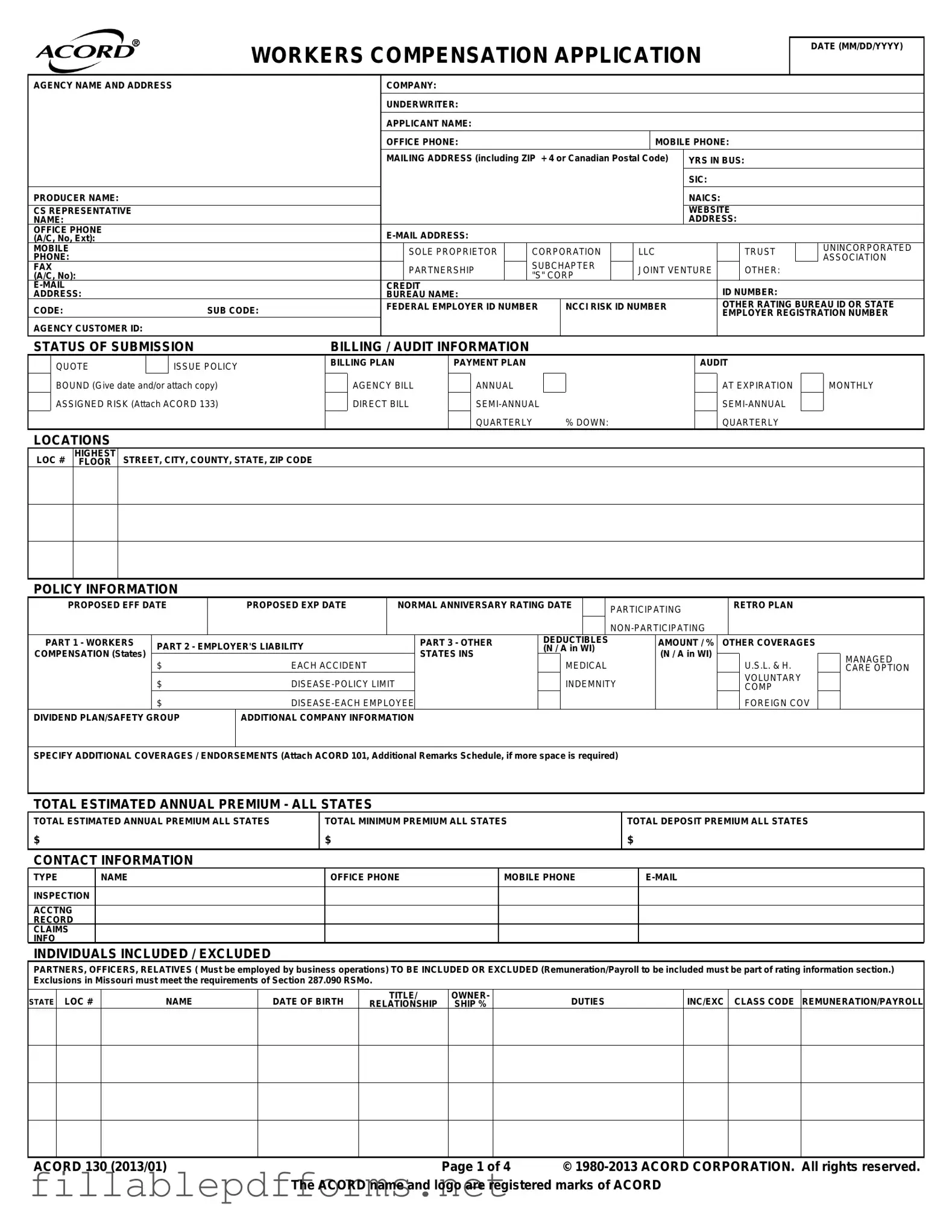

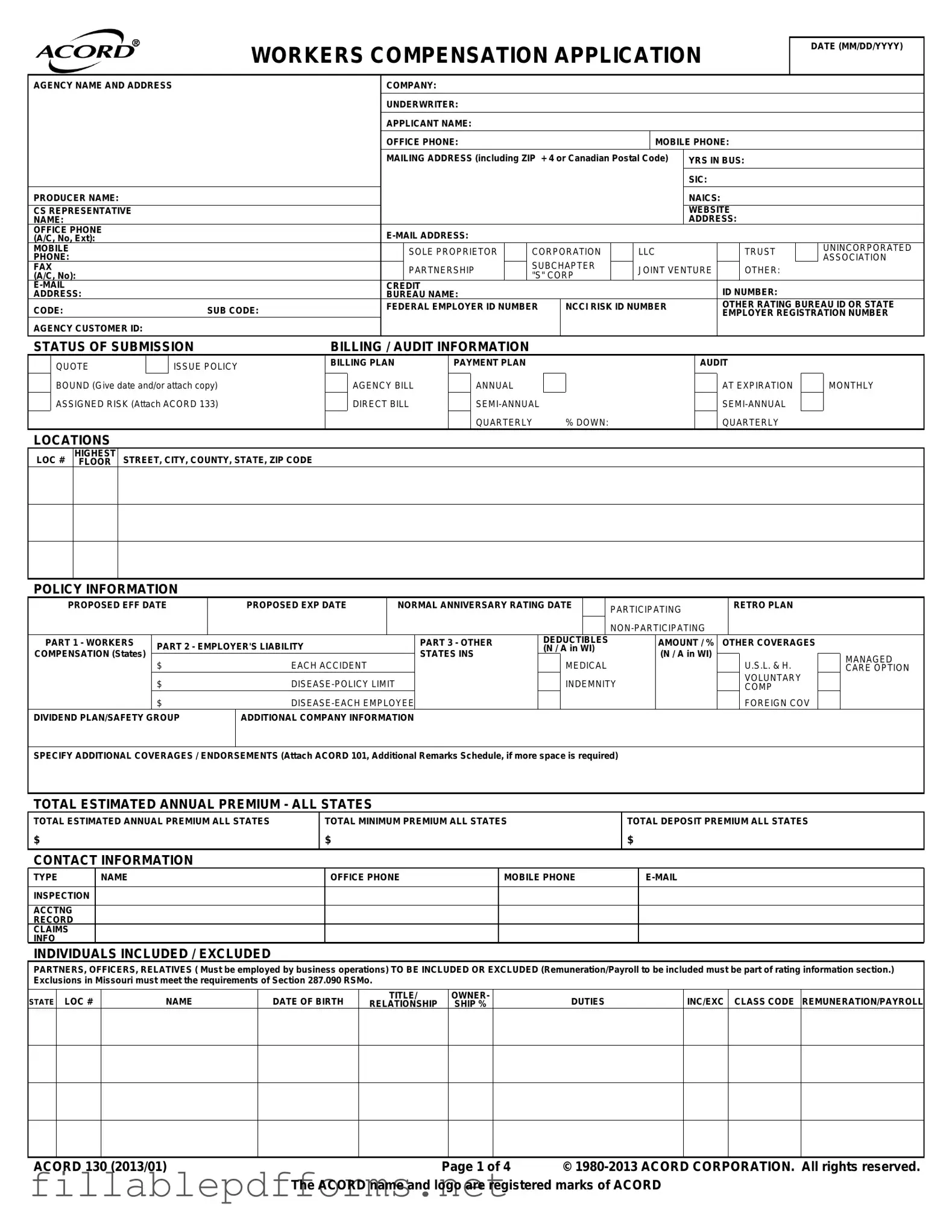

Acord 130 PDF Template

The Acord 130 form serves as a comprehensive application for workers' compensation insurance. This document collects essential information from businesses, including details about the applicant, coverage needs, and prior insurance history. Completing this form accurately is crucial for obtaining appropriate coverage and ensuring compliance with state regulations.

Launch Editor Here

Acord 130 PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Acord 130 PDF

Almost there — finish the form

Complete Acord 130 online fast — no printing, no scanning.